What's my borrowing capacity

However the better your home loan deposit the greater your borrowing capacity. Borrowing power or borrowing capacity refers to the estimated amount that you may be able to borrow for a home loan calculated generally as your net income income after tax minus.

General Surety Bonds Information Infographic Party Fail Commercial Insurance

It is a main component to determine the type.

. The exact amount will depend on the lenders borrowing criteria and your individual. Estimate how much you can borrow for your home loan using our borrowing power calculator. Whether you opt for a secured or unsecured personal loan will dictate what your maximum borrowing power is.

Borrowing capacity is defined by the amount you can obtain from your bank to finance the purchase of your future home. Your borrowing capacity is influenced by a number of different factors - and not all of them have to do with your savings. Factors that contribute into the borrowing power calculation.

Given interest rates at record lows as well as the possibility of additional decreases many people are considering either finally getting in the property market or making an investments in. This ratio takes your annual housing. Borrowing capacity or creditworthiness is the maximum amount that a company or individual can borrow without jeopardising their financial solvency.

For that reason care must be taken and see what assets you can lose in case you fail to pay it off successfully. Use our borrowing power calculator to get an estimate for how much you can borrow for your home loan in under two minutes. Buying or investing in.

So you might need to put on that sports car for another few years while you focus so dont take out big novated leases or. We would calculate your Borrowing Capacity using the below formula this is fairly standard and is similar to the calculation used by lenders. The borrowing capacity calculator will help give you the confidence to purchase your home.

900000 80 of purchase price. Borrowing capacity or creditworthiness is the maximum amount that a company or individual can borrow without jeopardising their financial solvency. Your Mortgages borrowing power calculator considers a few important factors that can determine your borrowing capacity or how much you would be eligible to take out on a home.

The external factors include. When the time comes to assess your borrowing capacity the first indicator used by financial institutions is the gross debt service or GDS. Calculating your borrowing capacity implies collateral or security loan as well.

When the time comes to assess your borrowing capacity the first indicator used by financial institutions is the gross debt service or GDS. Compare home buying options today. What determines your borrowing capacity and what factors influence how much you can borrow.

You can borrow up to 830000. Some factors that affect a borrowers capacity are external and therefore have little to do with the specific characteristics of the company. Borrowing capacity is the maximum amount of money you can borrow from a loan provider.

You can borrow up to 716000. Very high level numbers but you can borrow approx. In most cases income from.

View your borrowing capacity and estimated home loan repayments. This ratio takes your annual housing. Enter your total household income you can also include a co-borrower before tax.

There is a big difference. Get Your Estimate Today. Income expenses and your credit rating all play a role in a lenders.

The borrowing power shown using this calculator is an. The borrowing capacity calculator will help give you the confidence to purchase your home. If you purchase an investment.

Most lenders will allow you to borrow up to 95 of the property value. View your borrowing capacity and estimated home loan repayments. Your borrowing power or borrowing capacity is the maximum amount of money a lender will let you borrow for a mortgage.

However since you have a 100000 deposit I would assume that your borrowing is now 90 of the. The other thing with expenses is personal debts. Standard borrowing capacity is between.

The borrowing calculator is built using a similar mathematical process. For example if you cannot meet the terms described in the loan you are at risk of losing significant assets. Understanding borrowing capacity and what you can do to improve it is the first step to owning.

Ad Receive 200 if you get a loan with a better rate elsewhere terms apply. There are seven major reasons that will influence how much you can borrow. While each lender has its own in-house method for.

5 Tips To Help You Write Better Sales Listings And Sell Your Stuff Faster The Broke Generation Sell Your Stuff Chanel Inspired Pink Nikes

If You D Like More Reasons That Now Is The Right Time Give Me A Call Fixed Rate Mortgage Capital Gain Give It To Me

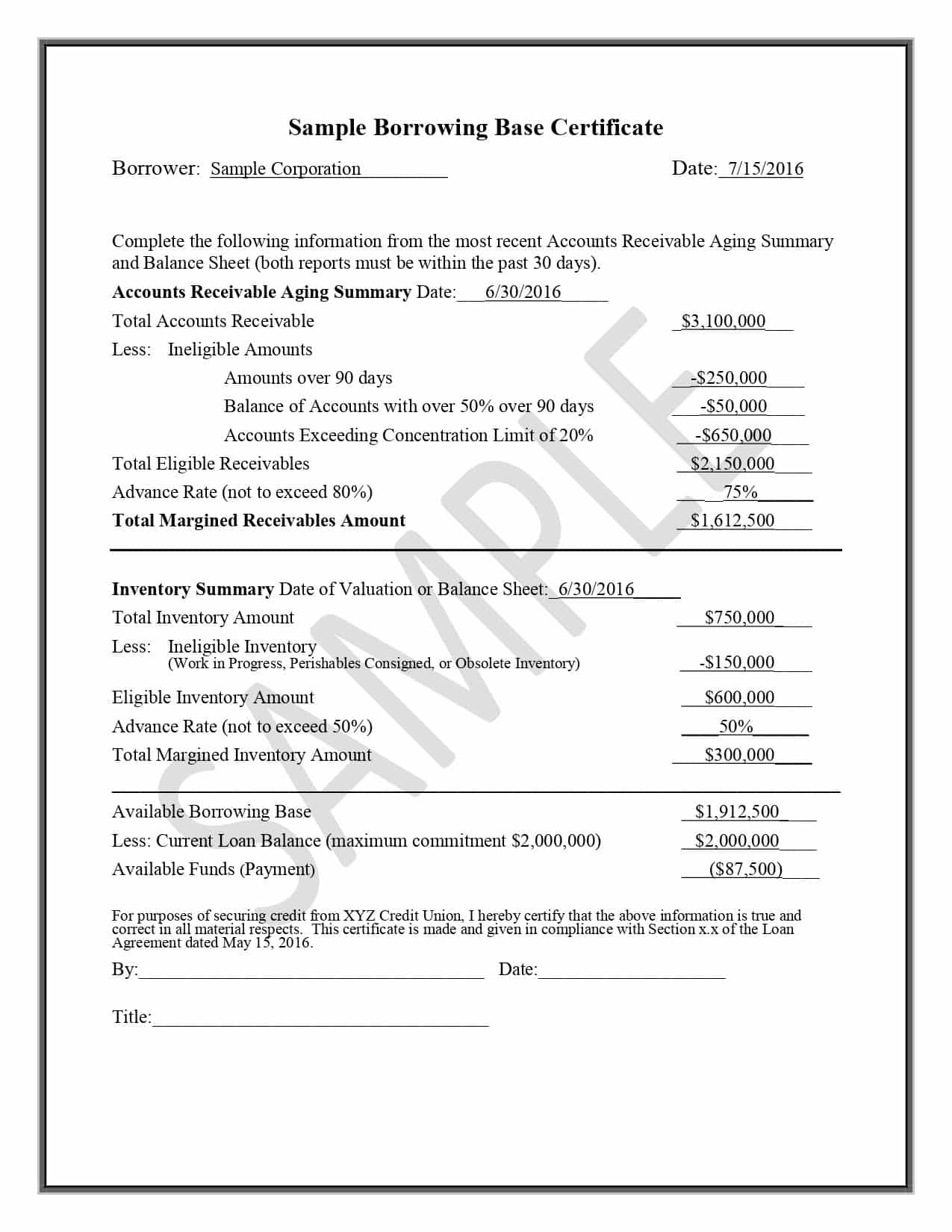

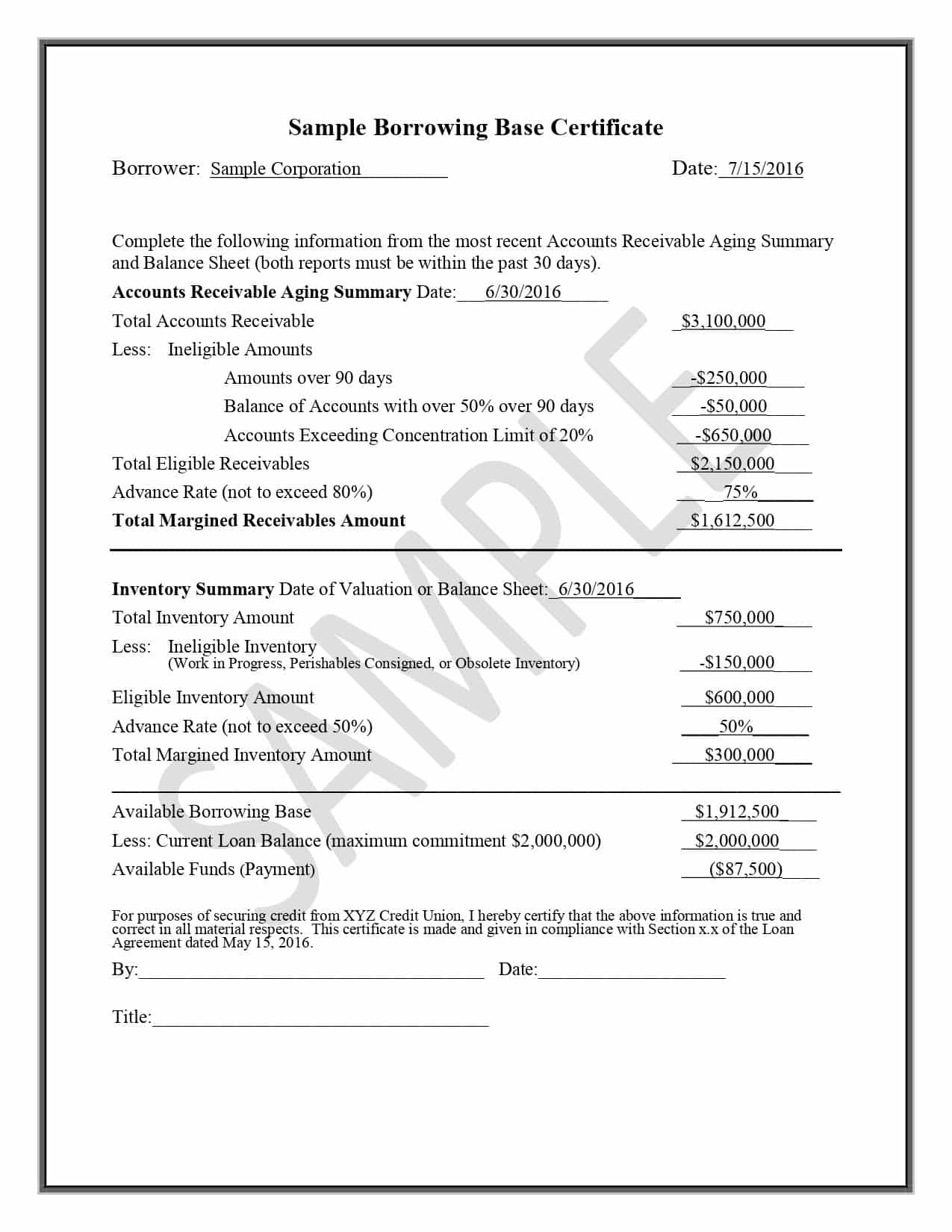

Borrowing Base What It Is How To Calculate It

Blue Streak Daily On Twitter Tesla Tesla S Tesla Model

How Much Can I Borrow Home Loan Calculator

What Can Affect Your Borrowing Power

Lvr Borrowing Capacity Calculator Interest Co Nz

Financial Loan Calculator Estimate Your Monthly Payments

How Fannie Mae And Freddie Mac Work Fannie Mae Borrow Money Understanding

Borrowing Power Calculator Sente Mortgage

Realtor Thanksgiving Kellerwilliams Homeownerhip Thanksfulforlist Benefitsofhomeownership Home Ownership The Borrowers Home Selling Tips

Bt38xjkmo86him

Borrowing Base What It Is How To Calculate It

Loan Calculator Credit Karma

Cairns Houses For Sale How Hecs Can Affect Your Mortgage Borrowing Power Real Estate Photography Selling Real Estate Real Estate

How Much Can I Borrow Home Loan Calculator

Lionel University Fitness And Nutrition Education Strength Training Fitness Fitness Goals